Beware the Siren’s Song: The Prohibited Transaction Trap

Prohibited Transactions by business service providers claiming to help, could sink the business you have worked so hard to make successful.

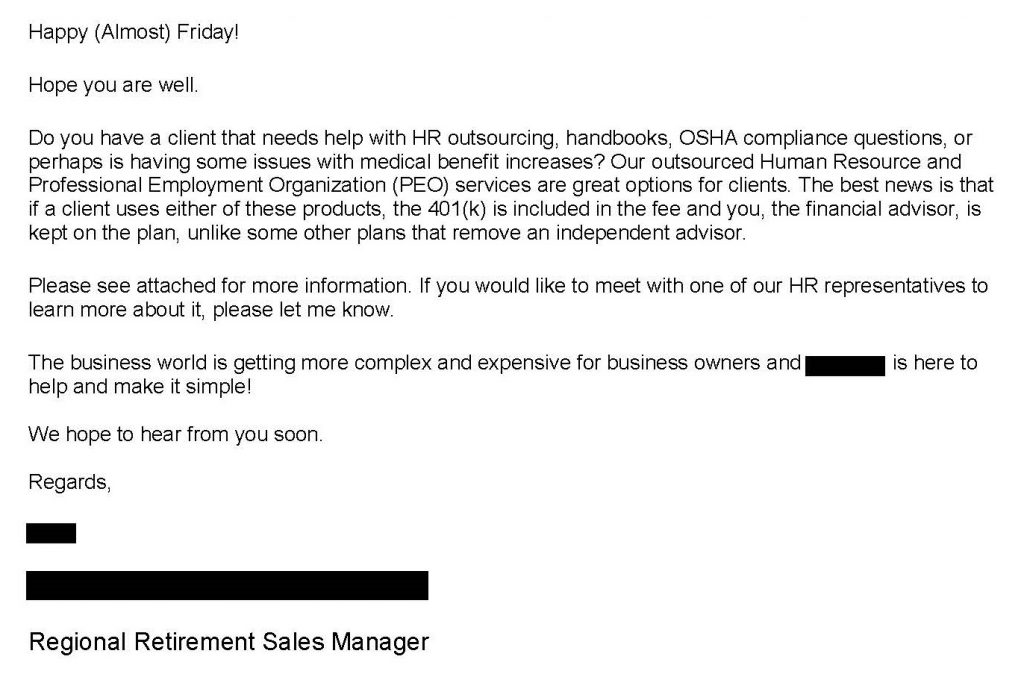

Case in point: Today I received the following email from one of the large payroll providers offering to absorb the administrative cost of the business 401(k) if the business will contract with them to provide payroll and HR services.

While this sounds like a great idea to help reduce costs, it is a prohibited transaction under ERISA regulations. Prohibited transaction fines from the Department of Labor (DOL) start at $150,000 per $1,000,000 in the corporate retirement plan and that is assessed against the owners and officers personally since there is no protection against a fiduciary violation. For many small business owners this could mean the end of their business.

So why is this such a problem and deemed a Prohibited Transaction? ERISA law states that the company retirement plan (an ERISA Plan) must be operated for the sole and exclusive benefit of the plan participants. This payroll provider’s email is offering a benefit to the company in exchange for operating the 401(k) which has no benefit to the plan participants and may even lead to less benefit depending on potential increased cost to the plan participants or other changes.

The majority of small to mid sized business owners, and their advisors , normally are not aware of such risks but that is our business.

To avoid these types of risks, increase efficiency and improve employee participation, the Accredited Investment Fiduciary (AIF®) professionals of Clear Financial Strategies stand ready to assist you and your business with achieving greater success.